Introduction

Navigating the world of permit surety bonds can feel like walking through a maze. With various regulations, requirements, and potential pitfalls, it’s crucial to understand every step involved, especially when it comes to filing claims. A permit surety bond acts as a safety net for both contractors and project owners, ensuring that projects are completed according to legal and regulatory standards. This article aims to demystify The Process of Filing Claims on Your Permit Surety Bond, providing you with an in-depth understanding of the procedures, important considerations, and best practices.

What is a Permit Surety Bond?

Understanding the Basics of Surety Bonds

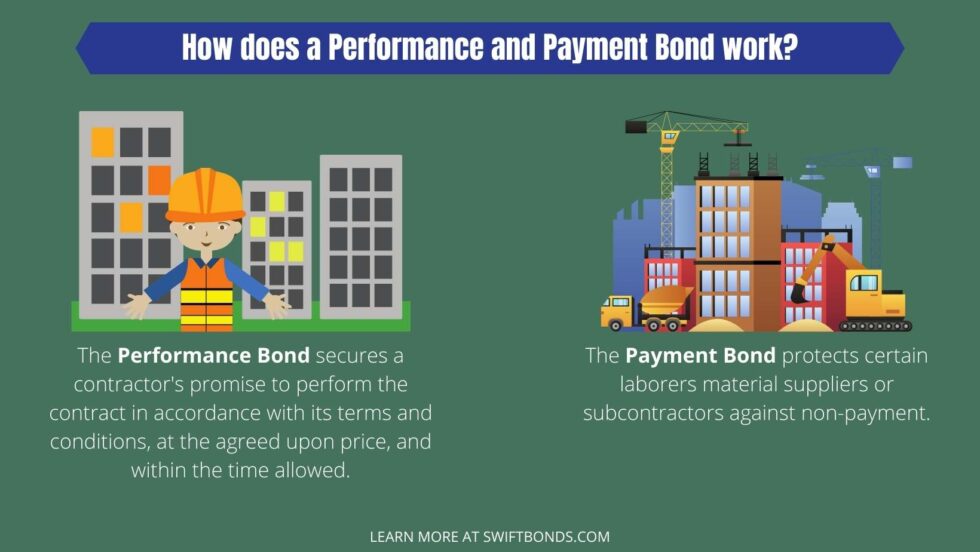

A permit surety bond is a type of contract among three parties: the principal (the contractor), the obligee (the entity requiring the bond), and the surety (the bonding company). The bond serves as a guarantee that the principal will adhere to specific laws and regulations related to their business or project.

Why Do You Need a Permit Surety Bond?

Permit surety bonds protect public interests by ensuring that contractors complete their obligations. They serve as financial assurance for entities such as municipalities or homeowners who may suffer losses due to non-compliance.

Types of Permit Surety Bonds

- Construction Bonds: Commonly required for construction projects. License Bonds: Necessary for businesses that need licenses to operate. Franchise Bonds: Often required by franchisors for their franchisees.

The Importance of Filing Claims on Your Permit Surety Bond

Protecting Your Interests with Claims

Filing a claim against your permit surety bond is essential if you believe there has been a breach of contract or failure to comply with regulations. It allows you to seek compensation for losses incurred due to another party's negligence or default.

Common Reasons for Filing Claims

Project Delays: If delays result from contractor negligence. Incomplete Work: Failure to finish work according to specifications. Non-Payment Issues: Not paying subcontractors or suppliers.The Process of Filing Claims on Your Permit Surety Bond

Step 1: Understanding Claim Eligibility

Before filing a claim, ensure you have valid grounds. The reasons must align with the terms outlined in your permit surety bond agreement.

Step 2: Review Contractual Obligations

Take time to thoroughly review your contract. Understand what obligations were not met and gather evidence supporting your claim.

Step 3: Gather Documentation

Collect all necessary documentation that substantiates your claim. This includes:

- Contracts Invoices Correspondence Photos or videos documenting the issue

Step 4: Contact Your Surety Company

Reach out to your surety provider as soon as possible. They can guide you through The Process of Filing Claims on Your Permit Surety Bond, including paperwork and timelines.

Step 5: Submit Your Claim

Follow your surety company's procedures for submitting claims meticulously. Ensure all documentation is complete and accurate.

Step 6: Await Investigation Results

After submission, the surety will investigate your claim. They may contact you for additional information during this period.

Step 7: Resolution and Payment

If your claim is validated, the surety will issue payment based on the terms outlined in your bond agreement.

Frequently Asked Questions (FAQs)

What happens if my claim is denied?

If your claim is denied, review the denial letter carefully. It usually explains why it was rejected. You may have grounds for appeal depending on the situation.

How long does it take to process a claim?

Claim processing times can vary widely but generally take anywhere from a few weeks to several months, depending on complexity and documentation required.

Can I file multiple claims against my permit surety bond?

Yes, but keep in mind that each claim must be justified, backed by appropriate evidence, and within the limits set by your bond coverage.

What costs are covered under my permit surety bond?

Typically, costs associated Helpful site with incomplete work or violations of contractual obligations are covered; however, always check your specific bond terms for limitations.

Is hiring an attorney advisable when filing claims?

In complex situations where significant funds are at stake or disputes arise, consulting an attorney experienced in construction law can be beneficial.

Can I file a claim if I’m not directly contracted with the principal?

In many cases, third parties such as subcontractors may file claims against a principal's bond if they have not been compensated properly under certain conditions outlined in state laws or regulations.

Conclusion

Understanding The Process of Filing Claims on Your Permit Surety Bond is vital for anyone involved in contracting work or managing projects requiring permits. From grasping what constitutes valid grounds for claims to knowing how best to document issues effectively—each step plays an essential role in securing protection against financial loss due to non-compliance or negligence. By following these guidelines diligently and leveraging professional advice when needed, you can navigate this landscape more confidently and efficiently ensure that all parties involved fulfill their legal obligations effectively.

This article provides comprehensive insights into navigating permit surety bonds while equipping readers with actionable knowledge on filing claims effectively—protecting both project investments and public interests alike!